Eclipse of the Forgotten: "The Resurgent Legacy of the Blackout Bestiary – Part II

"The Energy Transition: A Critical Analysis of Power"

1. "Plays: The Political Engineering of Energy Sector Chaos"

2. "Nord Stream: From Baltic Lifeline to Geopolitical Flashpoint"

3. "President Donald Trump's Deadly Uppercut to Nord Stream (2019)"

4. "Who Bears Responsibility in the Current Green Energy Crisis?"

5. "Energy Storage: The Holy Grail of Renewable Energy"

6. "Conclusion to The Fables of Blackout"

Gratitude is our heartbeat.

Inflation bites, platforms shift, and every post now fights for survival. We’re holding the line with premier tools, licensed software, and striking images—but we can’t do it alone.

Help us stay loud:

One click: Like, repost, or share on X, LinkedIn, or Energy Central—free, private, game-changing.

One gift: PayPal gjmtoroghio@germantoroghio.com | IBAN SE18 3000 0000 0058 0511 2611 | Swish 076 423 90 79 | Stripe (donation link).

Each gesture—tiny or titan—powers the words you read.

Thank you for keeping the flame alive.

All rights reserved by Germán & Co. Reproduction is strictly prohibited.

By Germán & Co.

Karlstad, Sweden | May 22, 2025

________________________________________

a. Introduction

The Energy Transition: A Critical Analysis

Germán & Co. has become a transformative voice in today’s rapidly evolving energy landscape. Our industry-shaping insights have garnered over 250,000 engagements across Energy Central’s platforms. With an industry-leading Reputation Score of 339,812—exceeding 99% of our sector peers—we demonstrate the authority and trust that our analyses command. We are ranked 15th among Energy Central’s global influencers, consistently advancing the energy conversation.

The viral success of publications such as “Greta Thunberg: Decoding the Icon Shaping Climate Discourse” (over 2 million views on X) and “Fluence Energy in the Amazing Voyage of India's Metamorphosis” (3,818 views on LinkedIn in one day and 49,000 views on X) highlights our ability to anticipate trends and translate complex information into actionable insights. Unlike conventional analysts, we combine data-driven precision with strategic vision, positioning Germán & Co. as the preferred partner for decision-makers navigating critical energy challenges. Global leaders rely on our insights to drive measurable progress when clarity is essential.

Our analysis series, “The Enigmatic Bestiary of the Blackout,” has become a cultural touchpoint, achieving over 1,000 views in just 24 hours on LinkedIn and sparking significant discussion with its bold examination of systemic decay. Part 2 of the saga reinforces its sharp argument that animal interference is a convenient scapegoat, a deliberate distraction from collapsing infrastructure and willful political negligence.

This piece is no mere commentary—it’s a myth-busting manifesto. With scalpel-sharp analysis, we expose how certain politicians weaponise ideology as slick marketing, bending facts to suit their agendas. Few sectors suffer more from this distortion than energy. The convenient trope of “nature’s chaos” deflects responsibility, but the uncomfortable truth remains: blackouts aren’t triggered by rogue raccoons—they result from systemic rot.

Part 2 delves deeper into the mystery, driven by viral momentum and audience demand. Join the reckoning and dare to confront the truths that "they" attribute to beasts. We have compared two case studies: Nord Stream and The Enigmatic Bestiary of the Blackout.

Hypothesis 1: If the Nord Stream pipeline blasts of September 2022 are interpreted not merely as isolated acts of sabotage but as a deliberate test of Europe’s dependency on Russian gas, then the subsequent fog of competing narratives—blaming everything from Kremlin false-flags to rogue Ukrainian divers—serves as strategic misdirection. By amplifying monstrous "beasts" in the public imagination, state actors can divert scrutiny from their energy policies, shield classified forensics from independent review, and renegotiate geopolitical leverage. At the same time, the actual technical evidence remains locked beneath official secrecy. In this case, the beast is the hidden hand, manipulating perceptions to obscure the real players and motives.

Hypothesis 2: If the Iberian Blackout of April 2025 is treated as the software-centered analogue to Nord Stream’s hardware attack, then framing the outage around animal scapegoats or freak coincidences similarly conceals structural grid fragilities: low inertia, vulnerable inverter firmware, and regulatory lag behind rapid renewable adoption. Together, the pipeline explosions and the blackout support a broader hypothesis that spectacular culprits—whether divers or mythical lynxes—are routinely deployed to mask systemic vulnerabilities, allowing political and industrial stakeholders to postpone costly reforms until the subsequent failure forces another cycle of blame. Here, too, the beast is the hidden hand, using misdirection to avoid accountability and reform.

________________________________________

On May 24, 2023, Matt Chester, Senior Editor at Energy Central, interviewed us and opened the discussion with a key observation:

"Energy news is no longer a niche topic reserved for industry professionals. Today, major developments in utilities, oil, and gas routinely make mainstream headlines—and for good reason. The energy sector now plays a pivotal role in shaping the global economy, international geopolitics, and even our everyday lives."

This shift underscores just how critical energy has become in today’s world.

In today’s fast-moving energy landscape, following the conversations that shape the industry is more essential—and more time-consuming—than ever. That’s why it helps to have community experts who comb through the headlines and surface the items that are most timely, impactful, and worth your attention. Germán Toro Ghio has been doing that before joining our Energy Central Network of Experts.

When we asked Germán how to navigate the extraordinary geopolitical turbulence facing oil and gas, from Russia’s war in Ukraine to OPEC’s market sway and the counter-moves of the United States and its allies, he offered this reflection:

“That’s a profoundly challenging question. It takes me back to those marathon corporate strategy sessions where we would dutifully model even the most improbable, seemingly absurd scenarios. Tragically, some of those scenarios have now come true, with dire consequences for the global economy and for humanity. As we look back, we must be both transparent and unsparing in our analysis. One crisis stemmed from a grave political miscalculation involving critical energy infrastructure; another lingering health crisis remains cloaked in uncertainty and speculation. Together they serve as a stark reminder of how quickly our world can unravel—and of the imperative to make wise decisions that place everyone’s safety and well-being first.”

On pressing concerns and reasons for optimism in the energy sector:

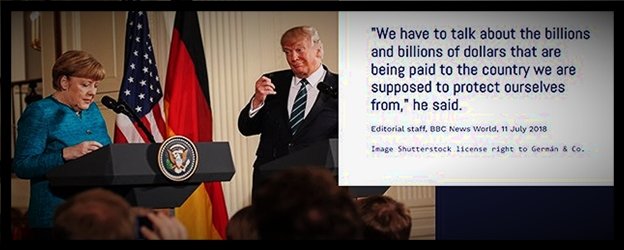

"I’m deeply concerned by the current trajectory and the reflexive, unexamined decisions it’s producing—though I’ll leave specific technologies out of this discussion for now.. While innovation should always be encouraged, we must never lose sight of the sector’s non-negotiables: dependable power generation and secure fuel supplies. If there’s cause for optimism, it’s that policymakers seem to be learning from past failures. Europe’s overreliance on a single pipeline and supplier stands as a stark lesson—one we cannot afford to repeat." Never forget this picture:

The Anatomy of Political Uncertainty in Energy Markets: A Multidimensional Crisis

The transition to low-carbon energy systems hinges on predictable policy frameworks that allow investors to price risk and allocate capital efficiently. Yet political actors frequently undermine this stability in liberalised markets, weaponizing uncertainty through mechanisms that distort market signals, inflate financing costs, and delay decarbonization. This phenomenon is not incidental but systemic, rooted in electoral cycles, geopolitical posturing, and reactive policymaking. Below, we dissect the five channels politicians amplify uncertainty, revealing how short-term political calculus jeopardizes long-term energy security and climate goals.

________________________________________

b. How Politicians Create Uncertainty in the Energy Sector

1. Rhetorical Signalling: The Power of Words Over Markets

Political rhetoric is rarely idle. Campaign promises, ideological statements, and even casual remarks can trigger significant shifts in energy markets before any legislation is enacted. For example, campaign speeches and spontaneous tweets can influence futures markets months before legal changes. A notable case is President Trump’s 2017 promise to revive “beautiful, clean coal,” which momentarily boosted Appalachian coal indices despite the absence of any supporting legislation (Plumer, 2017; Newell et al., 2019).

When candidates propose radical reforms—such as nationalizing utilities or banning fossil fuels—investors adjust their risk assessments quickly. Newell et al. (2019) illustrate how futures markets for oil, gas, and renewables respond to electoral debates, with price volatility increasing due to populist rhetoric. This “governance by soundbite” phenomenon creates a feedback loop: media amplification of political statements heightens perceived risk, distorting capital flows.

A tweet from a U.S. president about "ending fossil fuels" or a vow from a European leader to "phase out nuclear overnight" could lead to stranded assets or frozen investments, even if such policies encounter legislative blockages.

2. Regulatory Oscillation: The High Cost of Policy Whiplash

Given the sector's capital-intensive, long-term horizons, regulatory stability is the bedrock of energy investment. But abrupt policy reversals—driven by shifting political coalitions or public opinion—impose catastrophic costs. Germany’s nuclear saga epitomizes this: Chancellor Merkel’s 2010 decision to extend reactor lifespans (a pro-nuclear stance) was overturned in 2011 post-Fukushima, mandating a full phase-out by 2022. Overnight, utilities like RWE and E.ON faced €40 billion in stranded assets, while gas plants were hastily approved to fill the gap, raising emissions (Traber & Kemfert, 2012). Similarly, the UK’s 2015 retroactive cuts to solar subsidies bankrupted installers and eroded investor trust for years. Such oscillations force firms to hedge against political, rather than market, risk, raising capital costs and deterring innovation.

3. Strategic Sanctions: Geopolitics as Market Sabotage

Energy infrastructure has become a battleground for geopolitical coercion, with sanctions weaponised to destabilise competitors. The U.S. PEESA sanctions on Nord Stream 2, targeting firms involved in the pipeline’s construction, exemplify how extraterritorial measures override market logic. Despite EU regulatory approvals, the threat of secondary sanctions froze financing and delayed completion by years, raising the project’s cost by €10 billion (de Jong, 2022). These actions signal that even commercially viable projects are subject to political whims, compelling investors to price in "geopolitical risk premiums." The chilling effect extends beyond targeted projects: firms now scrutinise supply chains and partnerships for exposure to rival blocs, fragmenting global energy markets.

4. Politicized Permitting: When Red Tape Becomes a Political Tool

Permitting processes, ostensibly technical, are often hijacked for ideological or electoral ends. Spain’s 2012 suspension of renewable feed-in tariffs—retroactively slashing subsidies—paralyzed its wind and solar sectors, erasing €20 billion in investments and triggering over 50 international lawsuits (del Río & Mir-Artigues, 2012). More subtly, permitting delays for pipelines or grid upgrades can starve projects of capital. In the U.S., partisan battles over federal lands for drilling or renewables create bottlenecks, with permit approvals swinging dramatically between administrations. This politicization transforms bureaucracy into a lever for stifling disfavored technologies, chilling investment even in regions with abundant resources.

5. Security Shocks: The Unquantifiable Risk of Sabotage

Whether state-sponsored or opportunistic, physical attacks on energy infrastructure inject existential risk into markets. The 2022 Nord Stream pipeline explosion severed Europe’s gas supply, forcing insurers to reassess subsea cables, LNG terminals, and offshore wind farms globally. Premiums for such assets surged by 30–50% overnight, with insurers demanding unaffordable war-risk clauses (Kalm, 2024). Unlike market risks, sabotage threats defy actuarial modelling, creating "unknown unknowns" that deter long-term commitments. Politicians exacerbate this by failing to secure cross-border infrastructure or invest in grid resilience, exposing markets to cascading disruptions.

6. The Cumulative Toll: Financing Costs and Delayed Transitions

The IEA estimates that policy uncertainty adds 100–300 basis points to renewable energy financing in emerging markets—equivalent to a 20–30% increase in levelized costs (IEA, 2021). For context, this premium could render a viable solar project in India or Nigeria unbankable. In advanced economies, regulatory whiplash has slowed offshore wind deployment, with developers demanding higher power purchase agreements to hedge against retroactive policy changes. Fossil fuel interests often benefit from this chaos, as investors retreat to incumbent technologies with shorter payback periods, perpetuating carbon lock-in.

7. Toward Stability: Cross-Party Frameworks as Antidotes

Durable decarbonization requires insulating energy policy from electoral cycles. Denmark’s 2012 Energy Agreement, ratified by 95% of parliament, locked in 2050 net-zero targets, spurring consistent offshore wind investment. Similarly, Chile’s 2022 Green Hydrogen Strategy, backed by all major parties, has attracted $20 billion in commitments. Such frameworks prioritize incremental, consensus-driven reforms over grandstanding—a recognition that markets reward predictability, not political theater.

The energy transition is a technological or economic challenge and a test of political maturity. Until leaders cease treating energy policy as a tool for short-term gain, the world will pay a steep price: slower decarbonization, higher consumer costs, and a destabilized climate.

c. Nord Stream: From Baltic Lifeline to Geopolitical Flashpoint

________________________________________

1. Baltic Lifeline (2011)

On Tuesday, November 8, 2011, the quiet Baltic harbour of Lubmin in Germany briefly became the centre of Europe’s energy hopes. Surrounded by a forest of camera cranes, German Chancellor Angela Merkel stood alongside Russian President Dmitry Medvedev, French Prime Minister François Fillon, Dutch Prime Minister Mark Rutte (now NATO’s secretary general), and EU Energy Commissioner Günther Oettinger to inaugurate Nord Stream 1. This 1,224-kilometre twin gas pipeline runs from Vyborg to Germany. The day's rhetoric overflowed with superlatives: the pipeline was described as a "strategic lifeline," destined to provide half a century of reliable supply and free Europe from the unreliable overland routes that passed through Ukraine and Belarus.

Privately, Merkel had reservations. Unlike her predecessor, Gerhard Schröder, whose post-chancellorship role at Gazprom made him Moscow’s favoured German, Merkel does not trust the Kremlin nor view infrastructure as a reliable safeguard. She believed that cooperation was preferable to confrontation, and that the occasion called for optimism.

“Today we bridge not just nations but futures,” she declared, casting Nord Stream as both an engine of prosperity and a bulwark against energy insecurity.

By late 2012, the line was to deliver 55 billion cubic metres of Siberian gas each year—enough to heat 26 million households—while supposedly insulating Europe from the vagaries of transit politics. Yet critics warned that funnelling nearly one-third of the EU’s imports through a single supplier merely traded one vulnerability for another, echoing the continent’s Cold War dependence on Soviet pipelines.

A decade later, those warnings would prove prophetic; the “divine pipeline” would be revealed less as a celestial gift than as a geopolitical fault line.

________________________________________

Image licensed from Shutterstock, rights held by Germán & Co.

_______________________

2. President Donald Trump’s Deadly Uppercut to Nord Stream (2019)

Washington’s decision to sanction Nord Stream 2 in December 2019 marked a dramatic inflection point in the long-running tug-of-war over Europe’s energy future. For most of the 2010s, the twin-pipeline project under the Baltic Sea advanced steadily, promising to double Russia’s direct gas-export capacity to Germany while bypassing Ukraine and other Eastern European transit states. Yet that very promise—of deeper Russian leverage over Europe’s critical energy arteries—also crystallized Washington’s deepest strategic anxieties. When President Donald Trump signed the 2020 National Defense Authorization Act on 20 December 2019, he activated the Protecting Europe’s Energy Security Act (PEESA) and, with it, an unprecedented tool kit of sanctions aimed squarely at the vessels, insurers, financiers, and service providers enabling Nord Stream 2’s final kilometers of pipe-laying.

The immediate fallout was striking. Within twenty-four hours, the Swiss-Dutch contractor Allseas halted operations and withdrew its specialised pipe-laying ship, bringing construction to an abrupt standstill just 160 kilometres from the German coast. European capitals, already divided over the pipeline’s merits, were thrust into an awkward diplomatic triangle: Berlin condemned the U.S. move as extraterritorial overreach, Warsaw and Kyiv applauded it as overdue protection against Kremlin coercion, and Brussels tried—largely in vain—to broker a face-saving compromise. Meanwhile, Moscow vowed to finish the project with its assets, casting the sanctions as proof that American LNG exporters cared less about European security than about grabbing market share.

Yet the drama did more than freeze a single infrastructure project; it signalled a broader shift in U.S. foreign-policy doctrine. For the first time, Washington was willing to weaponize financial sanctions not merely to punish adversaries but to reshape allied countries’ commercial decisions in a sector as sensitive as energy. Over the following year the State Department repeatedly widened the net—issuing interpretive guidance in July and October 2020 that threatened penalties against any entity providing even “non-covered services,” Congress broadened the statutory mandate again with PEESCA in January 2021. When the outgoing Trump administration designated the Russian barge Fortuna and its owner KVT-RUS on 19 January 2021, a blueprint had been laid for using sanctions as an instrument of great-power competition in Europe’s gas markets.

Facing mounting pressure, the Kremlin and the state government of Mecklenburg‑Vorpommern—home to Nord Stream’s German landfall—devised a workaround. In January 2021 Premier Manuela Schwesig (SPD) set up the publicly chartered “Climate and Environmental Protection Foundation – MV” (Stiftung Klima‑ und Umweltschutz MV). Ostensibly green‑minded, the foundation received a €20 million endowment from Nord Stream 2 AG and was empowered to procure vessels, equipment, and services that private firms now shunned for fear of PEESA penalties. Critics labelled it a “sanctions‑evasion vehicle” operated with Moscow’s blessing; supporters argued it preserved local jobs and safeguarded energy security. Berlin watched warily, while Washington warned that laundering transactions through a foundation would not shield participants from future sanctions.

Framed against the cascading crises that followed—COVID-19’s demand shock, the 2021–22 energy-price spike, and Russia’s full-scale invasion of Ukraine—the 2019 sanctions now read like the opening chapter of a longer struggle to define Europe’s energy sovereignty. They exposed rifts within NATO, foreshadowed the Biden administration’s own hard choices (and temporary waiver) on Nord Stream 2, and demonstrated how infrastructure once considered a purely economic undertaking could be recast overnight as a strategic vulnerability. Understanding the origins, mechanics, and consequences of the Trump-era sanctions is essential, not merely to recount a policy skirmish, but to grasp the evolving playbook of energy statecraft in an age when pipelines and tankers matter as much as tanks and missiles.

________________________________________

3. Sabotage in the Baltic (2022)

At dawn on 26 September 2022, two powerful underwater explosions ripped open three of the four Nord Stream strings near Denmark’s Bornholm Island. Seismic stations recorded shocks equivalent to small earthquakes; methane plumes boiled to the surface.

Germany, Sweden, and Denmark quickly labelled the incident "deliberate sabotage." Military‑grade explosive residue was later found on recovered pipe sections, and investigators traced a rented yacht, Andromeda, to a still‑unconfirmed team of covert divers. Whether the culprits were state actors, freelancers, or proxies remains unresolved, but the strategic impact was clear:

Capacity lost: Nord Stream 1—already running at reduced flow—became inoperable; one of Nord Stream 2’s two lines was crippled before it ever shipped a molecule.

Risk repriced: Global insurers and operators reassessed the vulnerability of every subsea pipeline, telecom cable and power link.

NATO alarmed: The Alliance has created a Critical Undersea Infrastructure Coordination Cell, acknowledging that undersea assets are now frontline targets.

________________________________________

4. Strategic Lessons

Energy as Statecraft. Trump‑era sanctions highlighted how financial instruments can halt a multibillion‑euro project without a single soldier crossing a border.

Escalation Ladder. The 2022 blasts showed that sabotage can follow sanctions, turning valves into targets and turning them into bargaining chips.

Alliance Fault Lines. Nord Stream consistently exposed divergent threat perceptions: Berlin versus Washington, Warsaw and Kyiv; Brussels versus Moscow.

Accelerated Diversification. Each blow—sanctions, pandemic, invasion, explosions—pushed Europe to pivot away from Russian gas faster than any policy blueprint.

________________________________________

5. The Road Ahead

Nord Stream’s journey from celebrated lifeline to fractured liability mirrors Europe’s broader quest to marry affordable energy with strategic autonomy. Whether the following molecules arrive as green hydrogen through North‑Sea corridors or as LNG across the Atlantic, one constant endures: molecules and electrons travel only as securely as the politics that protect them.

Europe’s task is to craft an energy system resilient enough that no single sanction, blast, or bargaining chip can again darken its lights—or divide its alliance.

Nord Stream’s arc—from a symbol of post‑Cold‑War optimism to a ruptured monument of realpolitik—captures a larger truth: energy infrastructure is never just about molecules and megawatts; it is about power, trust, and the stories nations tell themselves. The pipeline’s rise and fall reveal three imperatives for the decades ahead:

Diversify or Depend? Europe cannot outsource its security to a single supplier or technology. Gas, renewables, hydrogen, efficiency—all must share the load so that failure anywhere is a catastrophe elsewhere.

Make Policy Boring Again. Markets crave predictability more than subsidies. Durable, bipartisan frameworks beat headline‑driven pivots, lowering capital costs and accelerating the clean‑energy transition.

Securing the Unseen. Cables, pipes, data links—what lies on the seabed underwrites prosperity on land. Protecting this critical undersea web is now as vital as defending airspace.

If leaders absorb these lessons, Nord Stream’s fractured steel may yet serve a purpose: a cautionary landmark pointing toward an energy system that is cleaner, cheaper, and—above all—harder to hold hostage.

________________________________________

References1. BMWK (Federal Ministry for Economic Affairs and Climate Action) (2022) ‘Extension of nuclear power plant operation for grid stability’, Press release, 17 October. Berlin: BMWK.2. del Río, P. and Mir‑Artigues, P. (2012) ‘Support for solar PV deployment in Spain: Some policy lessons’, Renewable and Sustainable Energy Reviews, 16(8), pp. 5557‑5566.3. de Jong, M. (2022) ‘Too little, too late? US sanctions against Nord Stream 2 and the transatlantic relationship’, Journal of Transatlantic Studies, 20(2), pp. 213‑229.4. Electric Reliability Council of Texas (ERCOT) (2022) Seasonal Assessment of Resource Adequacy (SARA) for Summer 2022. Austin: ERCOT.5. International Energy Agency (IEA) (2021) World Energy Investment 2021. Paris: IEA.6. Kalm, H. (2024) ‘NATO’s path to securing undersea infrastructure in the Baltic Sea’, Carnegie Endowment for International Peace, 29 May. Available at: https://carnegieendowment.org (Accessed: 22 May 2025).7. Lockwood, M., Mitchell, C. and Hoggett, R. (2016) ‘Competing paradigms of governance in UK energy policy: Calculating for, and governing through, markets’, Energy Policy, 95, pp. 632‑644.8. Newell, R.G., Raimi, D. and Aldana, G. (2019) Global Energy Outlook 2019: The Next Generation of Energy. Washington, DC: Resources for the Future.9. North American Electric Reliability Corporation (NERC) (2022) Texas February 2021 Cold Weather Event and Reliability Impacts. Atlanta: NERC.10. Plumer, B. (2017) ‘Trump Signs Executive Order Unwinding Obama Climate Policies’, The New York Times, 28 March. Available at: https://www.nytimes.com (Accessed: 22 May 2025).11. Traber, T. and Kemfert, C. (2012) ‘German nuclear phase‑out policy: Effects on European electricity wholesale prices, emission prices, conventional power plant investments and electricity trade’, DIW Berlin Discussion Paper 1219.12. Wiser, R., Bolinger, M. and Barbose, G. (2017) ‘Wind energy boom‑bust cycles, variability and price drivers in the United States’, Energy Economics, 65, pp. 305‑315._______________________________________

d. Who Bears Responsibility in the Current Green Energy Crisis?

An analysis of today's green energy landscape reveals divergent yet critical responsibilities among key stakeholders - from policymakers and financial institutions to well-funded environmental groups with sophisticated advocacy campaigns. The power industry is perhaps the weakest part of this complex chain. Many may wonder why this is the case. Politicians have played a crucial role in shaping the renewable energy landscape by setting ambitious targets and implementing generous subsidies to accelerate the transition from fossil fuels. However, this enthusiasm has sometimes lacked foresight, leading to oversights in critical areas such as energy security and supply diversification. Policymakers have dangerously underestimated the oil industry's enduring influence while failing to address growing security threats. In recent years, cyberattacks, terrorist sabotage, and attacks on critical infrastructure—including the repeated targeting of undersea power cables serving North Sea offshore wind farms—have exposed these vulnerabilities. Europe's over-reliance on a single energy supplier and pipeline network has demonstrated the consequences of such oversight. This crisis underscores a fundamental truth: effective energy policy must marry environmental ambition with operational realism, prioritising security and diversified supply chains. (10)

Indeed, financial institutions, too, have substantially influenced the trajectory of the energy sector, often driven by immediate profitability and compliance with emerging environmental, social, and governance (ESG) criteria. While crucial for long-term sustainability, the banking sector's enthusiastic embrace of renewable projects has occasionally overshadowed essential investments in complementary technologies and infrastructure, such as energy storage and grid modernisation (IEA, 2020; World Economic Forum, 2021). President Donald Trump has been a vocal critic of ESG (Environmental, Social, and Governance) mandates, arguing that they impose burdensome regulations on the energy sector and hinder economic growth. He has taken steps to roll back such policies, including issuing executive orders to halt the enforcement of state laws targeting energy companies over climate change and ESG initiatives. Moreover, the rapid divestment from fossil fuel projects—partly driven by ESG mandates—has unintentionally led to shortfalls in energy supply. This has contributed to market volatility and heightened short-term risks. These developments underscore the importance of financial strategies that support urgent climate action and ensure a stable and managed energy transition. (11)

Center for Sustainability & Excellence+4esgdive.com+4hklaw.com+4Independent Women's Forum

________________________________________

e. Sustainable Energy: The Paradox of Balancing Idealism and Pragmatism in a Polluted World.

For more than a century, industrial activity has saturated Earth’s ecosystems with pollutants, from microplastics choking marine life to heavy metals leaching into groundwater. The oceans, often romanticised as pristine frontiers, are archives of human negligence: discarded fishing gear smothers coral reefs, agricultural runoff fuels dead zones, and traces of mid-twentieth-century nuclear tests lie even in the Mariana Trench. Beyond Earth, the exosphere has become a junkyard of ambition, cluttered with over 9,000 tons of derelict satellites and rocket debris—a monument to humanity’s habit of externalizing costs. Set against this backdrop, the intense scrutiny of transitional energy technologies sometimes appears disproportionate. Nuclear power, for instance, contributes less than 1 % of the ocean’s radioactivity (naturally occurring potassium-40 dominates), yet fears of contaminated coolant water often eclipse its capacity to avert gigatonnes of carbon emissions.

This is not to dismiss environmental concerns, but to insist on calibration. Climate scientist James Hansen, an early voice on global warming, argues that nuclear energy’s dense, reliable output is indispensable while renewables scale. Modern reactor designs—small modular reactors (SMRs), molten-salt systems, and advanced fuel recycling (pioneered for decades in France)—promise higher safety margins and lower waste volumes. Although a fossil fuel, natural gas can also serve as a tactical reprieve: replacing coal (still 35 % of global electricity) can roughly halve CO₂ per kilowatt-hour and sharply cut particulate pollution. The International Energy Agency emphasises that if paired with strict methane controls and explicit sunset clauses, gas infrastructure can buy time for wind, solar, and grid storage to mature (IEA 2019).

1. National snapshots

France launched its civilian nuclear programme in the 1950s, accelerating after the oil shocks of the 1970s. Today, 56 pressurised-water reactors across 18 sites generate about 70 % of France's electricity, giving the country low-carbon power and energy security. French expertise extends to the European Pressurised Reactor (EPR) and next-generation concepts such as SMRs.

Under Energy Minister Ebba Busch, Sweden has pivoted back to nuclear energy. Legislation enacted in 2023 streamlines licensing, classifies nuclear energy as “green” under the EU taxonomy, and envisages up to ten new reactors—including SMRs—by 2045. Six existing reactors already supply roughly 30 % of Sweden's electricity.

After decades of oscillating policy, Germany shut its final three reactors in April 2023. A 2025 poll showed 55 % public support for revisiting nuclear, and the new conservative government has softened its stance. Yet technical, economic, and political barriers make a near-term restart unlikely; the focus remains on accelerating renewables and securing diversified energy imports.

Spain experienced a nationwide blackout on 28 April 2025, during which all seven reactors shut down automatically yet cooled safely on backup power. The incident reignited debate over Madrid’s roadmap to phase out nuclear power between 2027 and 2035, highlighting the resilience challenges of grids dominated by variable renewables.

2. Activism, politics, and pragmatism

Environmental movements have been pivotal in raising climate awareness, from multilateral milestones like the Paris Agreement to grassroots campaigns like Fridays for Future. Nevertheless, critics note a perceived elitism: policies championed by well-educated urban activists can appear disconnected from working-class realities, a gap exploited by populist parties that blame green measures for higher living costs (Malm 2021; Lockwood 2018). Ultra-conservative factions frame aggressive environmental regulation as an economic burden on younger generations already priced out of housing and stable employment (Spash 2021).

Opponents of transitional technologies warn of moral hazard—investments today might entrench carbon-intensive infrastructure tomorrow. Yet climate models show the cost of delay is steeper. Solar and wind, while transformative, remain intermittent, geographically constrained, and land-intensive; even bullish forecasts suggest they cannot carry global demand alone before mid-century. Outright rejection of nuclear and gas risks prolonging coal’s dominance—a far deadlier adversary. Nuanced policy is essential: prioritise renewables, allow transitional technologies under strict time limits, and embed sunset mechanisms.

In the end, environmentalists must confront uncomfortable trade-offs. Perfect solutions suit a planet changing slowly; ours, warming rapidly, demands pragmatic triage. As Hansen et al. (2013) note, “Opposition to nuclear power threatens humanity’s ability to avoid dangerous climate change.” The same logic applies to the judicious use of gas: to fixate solely on the bridge’s risk is to ignore the precipice on either side.

3. Towards a balanced transition

Constructive convergence is already visible. European policymakers, chastened by recent energy-security shocks, now favour diversified low-carbon portfolios; financial institutions increasingly tie capital to credible transition plans; and some environmental groups are adopting more inclusive, strategically flexible positions. Successful energy transitions will depend on integrating ecological ambition, economic prudence, and robust security, while maintaining public trust through relatable, evidence-based advocacy.

________________________________________

References1. Hansen, J., et al. (2013). "Preventing Dangerous Climate Change." *Atmospheric Chemistry and Physics.*2. International Energy Agency (IEA). (2019). "The Role of Gas in Today’s Energy Transitions."3. Malm, A. (2021). "How to Blow Up a Pipeline." Verso Books.4. North, D. (2011). "The Environmental Movement and the Politics of Class." Environmental Politics.5. Lockwood, M. (2018). "Right-Wing Populism and the Climate Change Agenda." Environmental Politics.6. Spash, C. (2021). "The Political Economy of the Paris Agreement on Human Induced Climate Change." Globalizations.7. Stokes, L., & Warshaw, C. (2017). "The Politics of Energy and Climate Change in the United States." Energy Policy.8. United Nations Framework Convention on Climate Change (UNFCCC). (2015). "Paris Agreement."________________________________________

f. Conclusion of The Fables of Blackout

1. The Anatomy of Infrastructure Failure and Political Deflection

Spain's energy blackouts represent more than isolated technical failures—they constitute a revealing lens through which to examine the complex interplay between infrastructure vulnerability, political accountability, and the contested narratives that emerge when systems fail. The phenomenon of "El Apagón Felino" serves as a particularly instructive case study, not merely because a lynx was initially blamed for a grid failure, but because this scapegoating reveals the systematic tendency of institutions to externalize responsibility when confronted with the uncomfortable reality of their inadequate planning.

This pattern of deflection is neither accidental nor unique to Spain. When critical infrastructure fails, the immediate institutional response often involves identifying the most politically palatable explanation—preferably one that absolves human decision-makers of responsibility. Wildlife, weather events, or "acts of God" become convenient culprits, deflecting attention from the more uncomfortable truths about deferred maintenance, inadequate investment, or systemic design flaws. The lynx becomes a metaphor for broader institutional failures to acknowledge and address the growing gap between ambitious renewable energy targets and the fundamental infrastructure investments required to support them.

2. The Paradox of Renewable Success and Grid Instability

Spain's position as a renewable energy leader presents a fascinating paradox that illuminates the complexities of energy transition. The country has achieved remarkable success in renewable deployment—solar and wind now constitute significant portions of its energy mix, positioning Spain as a climate policy exemplar. Yet this success has exposed profound vulnerabilities in the broader energy ecosystem, creating new forms of instability even as it addresses others.

The rapid scaling of renewable capacity has fundamentally altered the physics of the Spanish grid. Traditional power systems were designed around the predictable, controllable output of centralized fossil fuel and nuclear plants. Integrating massive amounts of variable renewable energy has introduced new technical challenges that existing infrastructure was never designed to handle. Grid operators now must manage dramatic fluctuations in supply that can occur within minutes, as cloud cover shifts across solar installations or wind patterns change across vast wind farms.

This transformation has created what energy engineers describe as the "integration challenge"—the gap between renewable energy potential and the grid's ability to utilize that potential effectively. Spain regularly experiences periods where renewable generation exceeds demand, forcing operators to curtail output and waste clean energy. Conversely, during periods of low renewable generation, the system struggles to maintain stability without adequate backup capacity or storage resources.

3. The Critical Role of Energy Storage in Grid Transformation

Energy storage emerges as perhaps the most critical missing piece in Spain's renewable puzzle. The intermittency challenge is not merely a technical inconvenience—it represents a fundamental mismatch between the temporal patterns of renewable energy generation and electricity demand. Solar generation peaks during midday hours when commercial demand is high but residential demand remains moderate, while wind patterns often peak during nighttime hours when overall demand is lowest.

The temporal mismatch creates cascading problems throughout the energy system without adequate storage capacity. Excess renewable energy that cannot be stored becomes a liability, forcing grid operators to curtail clean energy production or export surplus power at unfavourable prices to neighbouring markets. During periods of low renewable generation, the system must rely heavily on remaining fossil fuel plants, which are increasingly expensive to maintain as they operate less frequently and less predictably.

Deploying grid-forming batteries and other advanced storage technologies represents more than just a technical upgrade—it constitutes a fundamental reimagining of how electrical grids operate. Unlike traditional "grid-following" renewable installations that feed power into existing grid infrastructure, grid-forming technologies can help provide the stability services that traditional power plants once provided. These systems can respond to frequency fluctuations, provide voltage support, and help maintain grid stability during rapid changes.

However, the required storage deployment scale is staggering. Spain would need to install storage capacity measured in tens of gigawatt-hours to manage its renewable fleet's variability effectively. The investment would rival the cost of the renewable installations themselves. This reality highlights why storage cannot be treated as an afterthought in renewable energy planning but must be integrated from the earliest stages of system design.

4. Economic Interests and the Battle for Energy's Future

The ideological battles surrounding the energy transition cannot be separated from the powerful economic interests that shape energy policy and infrastructure investment. The renewable energy sector has evolved into a massive industrial complex, with manufacturers, developers, and financial institutions holding billions of dollars in assets tied to continued renewable deployment. These stakeholders have powerful incentives to promote rapid renewable expansion, sometimes with insufficient attention to the infrastructure investments needed to support that expansion effectively.

Simultaneously, incumbent fossil fuel and nuclear industries face existential threats from renewable energy growth. Their responses have ranged from attempting to slow renewable deployment through regulatory and legal challenges to pivoting their business models to maintain relevance in a changing energy landscape. Utility companies are caught in the middle, maintaining grid reliability while navigating rapidly changing technology costs, regulatory requirements, and customer expectations.

Financial institutions add another layer of complexity, as they increasingly view renewable energy projects as attractive investment opportunities while simultaneously holding significant exposure to existing fossil fuel infrastructure. This creates complex incentive structures where the same institutions may simultaneously finance renewable energy expansion and lobby against policies that would accelerate the retirement of existing fossil fuel assets.

The result is an energy policy landscape shaped as much by these competing economic interests as by technical requirements or environmental concerns. Subsidy structures, market design rules, and regulatory frameworks often reflect political compromises between these interests rather than optimal engineering solutions. Spain's experience illustrates how this dynamic can lead to renewable energy deployment that outpaces supporting infrastructure, creating new vulnerabilities even as it addresses climate concerns.

5. Regulatory Frameworks and the Challenge of Adaptive Governance

The regulatory challenges exposed by Spain's renewable transition extend far beyond simple rule-making to fundamental questions about how governance systems adapt to technological change. Traditional electricity regulation developed around stable, predictable systems dominated by large, centralized power plants. Integrating massive amounts of variable renewable energy requires new regulatory approaches to accommodate uncertainty, promote flexibility, and coordinate across multiple time scales and geographic boundaries.

Current regulatory frameworks often struggle to price the true value of flexibility and reliability in systems with high renewable penetration. Traditional electricity markets focus primarily on energy commodity prices, with limited mechanisms to reward grid stability services that become increasingly valuable as renewable penetration increases. This creates situations where renewable energy installations can appear economically attractive in isolation while imposing hidden costs on overall system stability.

Spain's experience suggests that regulatory evolution must occur at the same pace as technological deployment. Delayed regulatory adaptation creates periods of uncertainty that can discourage the infrastructure investments needed to support renewable integration. Grid operators, storage developers, and other critical system participants need clear, consistent regulatory signals to justify the substantial investments required for a successful energy transition.

6. Geopolitical Complexity and Energy Security in Transition

The broader geopolitical context surrounding energy infrastructure adds layers of complexity that go far beyond domestic policy considerations. The Nord Stream pipeline attacks, cyberattacks on grid infrastructure, and threats to undersea power cables illustrate how energy systems have become critical components of the international security architecture. For energy companies operating in this environment, geopolitical risk has evolved from a peripheral concern to a central business consideration.

Spain's position as a European energy hub connected to North Africa through undersea cables and to France through cross-border transmission lines makes it particularly vulnerable to geopolitical disruption. The country's renewable energy transition occurs against broader European energy security concerns, Russian energy supply disruptions, and growing awareness of energy infrastructure as a target for state and non-state actors.

This geopolitical dimension creates additional challenges for energy system planning. Infrastructure investments that make economic sense from a purely domestic perspective may become liabilities if they increase exposure to international disruption. Conversely, investments in energy independence and resilience may be economically suboptimal in the short term while providing crucial strategic value over longer time horizons.

7. The Management Challenge: Navigating Radical Uncertainty

For energy company executives operating in this environment, the challenge extends beyond traditional business management to navigating fundamental uncertainty about the future structure of energy systems. The transition from fossil fuels to renewables represents not merely a fuel switch but a comprehensive transformation of energy system architecture, market structures, regulatory frameworks, and geopolitical relationships.

Traditional business planning models, built around relatively predictable regulatory environments and stable technology costs, become inadequate when facing the radical uncertainty of the energy transition. Companies must simultaneously manage existing assets with declining long-term value, invest in new technologies with uncertain returns, and navigate regulatory frameworks in flux.

The Spanish experience illustrates how quickly energy system realities can change. Companies that invested heavily in renewable development faced unexpected curtailment and grid stability challenges. Utilities that deferred grid modernization investments discovered that their infrastructure could not accommodate the renewable energy they were required to integrate. Financial institutions that provided capital based on traditional energy system assumptions faced new categories of stranded asset risk.

8. Toward Integrated Energy System Planning

Spain's renewable energy transition offers crucial insights for other countries and regions embarking on similar transformations. The most important lesson may be that successful energy transition requires integrated system planning that addresses renewable energy deployment, grid infrastructure modernization, storage development, and regulatory framework evolution as interconnected challenges rather than separate issues.

The technical requirements for high-renewable energy systems are now well understood. The challenge lies in developing institutional capabilities to coordinate investments across these multiple dimensions while managing the political and economic interests that shape energy policy. Spain's experience suggests that countries can avoid some of the growing pains of renewable transition by treating grid modernization and storage deployment as prerequisites for, rather than consequences of, large-scale renewable energy development.

This integrated approach requires new forms of collaboration between government agencies, utility companies, renewable energy developers, and technology providers. It also requires regulatory frameworks sophisticated enough to provide appropriate price signals for the full range of services needed to maintain grid stability in high-renewable systems.

The stakes of getting this integration right extend beyond technical performance to questions of public confidence in renewable energy transition. Infrastructure failures that can be blamed on renewable energy integration, regardless of their actual causes, provide ammunition for opponents of climate action. Conversely, successful integration that maintains high levels of grid reliability while achieving deep decarbonization can be a powerful demonstration of renewable energy viability.

Spain's ongoing experience will continue to provide valuable insights as the country works to resolve the tensions between its renewable energy ambitions and infrastructure realities. The lessons learned—both positive and negative—will prove invaluable for the dozens of other countries now embarking on similar transitions, facing similar challenges, and navigating similar complexities in their own journeys toward sustainable energy systems.

You can't possibly deny me...

Have a wonderful day filled with good health, happiness, and love…

In December 2023, Energy Central recognized outstanding contributors within the Energy & Sustainability Network during the 'Top Voices' event. The recipients of this honor were highlighted in six articles, showcasing the acknowledgment from the community. The platform facilitates professionals in disseminating their work, engaging with peers, and collaborating with industry influencers. Congratulations are extended to the 2023 Top Voices: David Hunt, Germán Toro Ghio, Schalk Cloete, and Dan Yurman for their exemplary demonstration of expertise. - Matt Chester, Energy Central

Gratitude is our heartbeat.

Inflation bites, platforms shift, and every post now fights for survival. We’re holding the line with premier tools, licensed software, and striking images—but we can’t do it alone.

Help us stay loud:

One click: Like, repost, or share on X, LinkedIn, or Energy Central—free, private, game-changing.

One gift: PayPal gjmtoroghio@germantoroghio.com | IBAN SE18 3000 0000 0058 0511 2611 | Swish 076 423 90 79 | Stripe (donation link).

Each gesture—tiny or titan—powers the words you read.

Thank you for keeping the flame alive.

You can't possibly deny me...

Have a wonderful day filled with good health, happiness, and love…